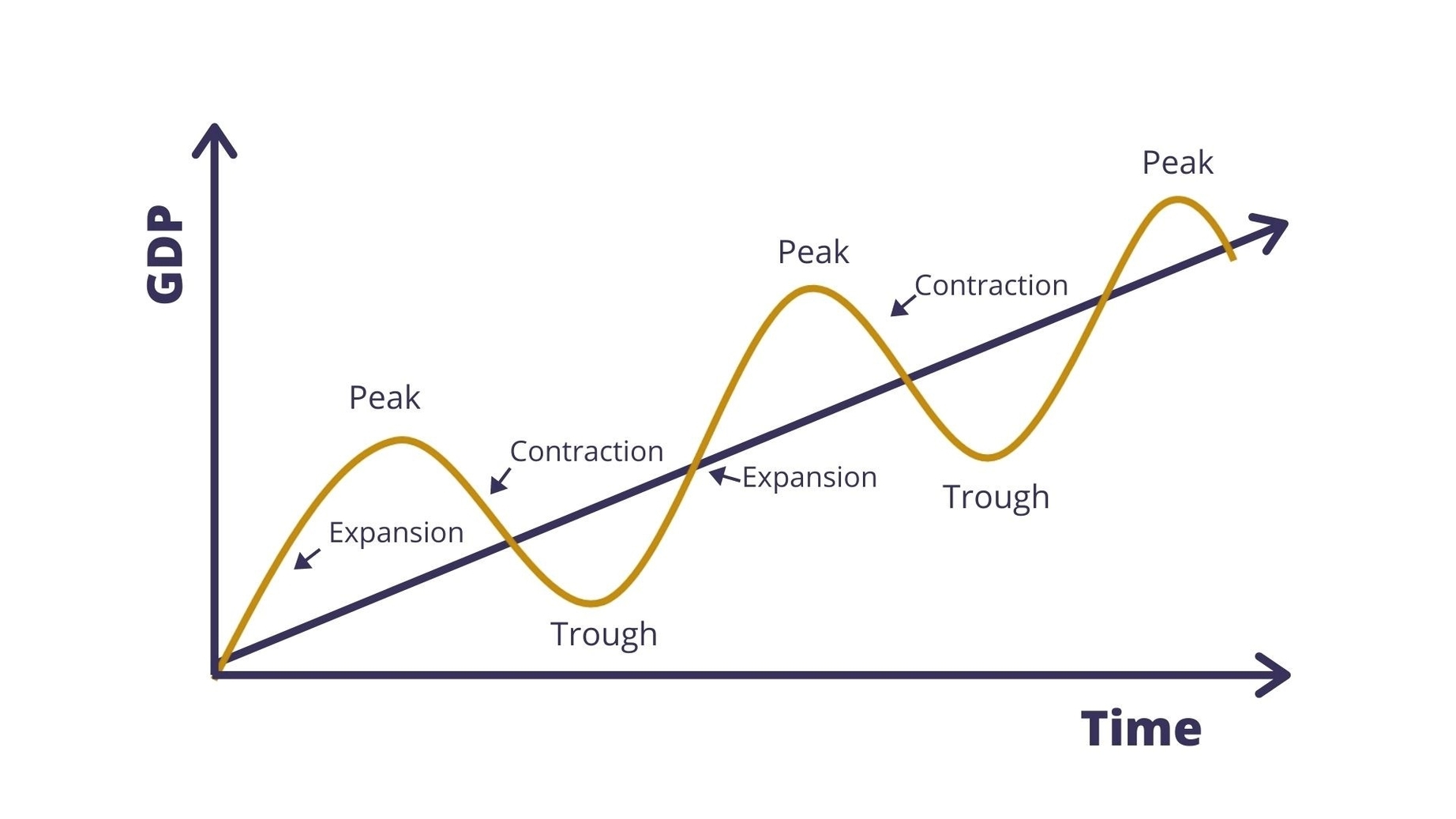

Real Estate Investment In Economic Cycles: Real estate investment in economic cycles involves understanding how property values and demand fluctuate with economic conditions, requiring strategic timing for buying and selling.

Charts | Diagrams | Graphs